Calculate Your Personal Loan EMI

Sorry

This video does not exist.

| Period | Payment | Interest | Balance |

|---|

Calculator Disclaimer

The repayment amount shown is an estimate based on the information you provide. It is for illustration only, and actual repayment amounts may vary. To get the actual repayment amount, Contact us or visit the official bank website or Nearby Banks. This calculation is not a quote, loan approval, agreement, or advice from My Finance. It does not consider your personal or financial situation.

Personal loans can be a lifesaver for many situations—unexpected expenses, weddings, travel, or even consolidating debt. If you’re in the UAE, Mashreq Bank offers several personal loan options to suit diverse financial needs.

Here’s a detailed guide to help you understand everything about Mashreq Bank personal loans, how they work, and how you can apply.

What Is a Personal Loan?

A personal loan is money borrowed from a bank that you agree to repay over a set period with interest. It is “unsecured,” meaning you don’t need to provide collateral, like a house or car. People often use personal loans for various purposes, such as:

- Home renovations

- Paying off credit card debts

- Medical emergencies

- Starting a business or expanding an existing one

Mashreq Bank Personal Loan Features

Mashreq Bank provides different types of personal loans, tailored to various needs. Below are the key loan types and their features:

1. Personal Loan for Existing Customers

- Loan Amount: Up to 20x your salary, capped at AED 1 million

- Interest Rate: From 2.99% per year

- Repayment Period: 3 to 60 months

- Approval Time: Instant approval within 5 minutes

- First Installment: Can be deferred for up to 90 days

- Eligibility: Minimum monthly salary of AED 5,000 (for approved companies) or AED 10,000 (for unapproved companies)

2. Personal Loan for New Customers

- Similar features to loans for existing customers.

- Additional Step: Upload documents, including a salary transfer letter and passport copy, for verification.

3. Neo Credit Instant Loan

- Loan Amount: Up to AED 35,000

- Interest Rate: From 19.49% per year

- Repayment Period: 2 to 18 months

- Approval: Online approval in 5 minutes

- Benefits: No salary transfer required; zero documentation needed

4. Debt Consolidation Loan

- Loan Amount: Up to AED 1.5 million

- Interest Rate: From 2.99% per year

- Purpose: Combine multiple debts into one manageable payment

- Key Benefit: Lower monthly payments

Who Can Apply?

To qualify for a Mashreq Bank personal loan, you must meet these requirements:

- Age: 21 to 60 years

- Residency: UAE residents and expatriates are eligible

- Employment: Must have a monthly salary of AED 5,000 to AED 7,000, depending on your employer

- Credit History: A good credit score increases approval chances

- Employment Duration: At least 6 months with your current employer

Documents You’ll Need

Here are the basic documents required for all personal loans from Mashreq Bank:

- Emirates ID: For identification

- Passport with Visa: For expatriates

- Salary Certificate: Proof of income from your employer

- Bank Statements: Typically for the last 3–6 months

- Address Proof: Utility bill or tenancy contract

Note: Additional documents may be required based on the loan type.

How to Apply for a Mashreq Bank Personal Loan?

Follow these simple steps to apply:

- Visit the Mashreq Bank Website: Navigate to the personal loan section.

- Click on “Apply Now”: Enter your mobile number, email, and other details.

- Receive OTP: Mashreq Bank will send you a One-Time Password (OTP) to verify your phone number.

- Fill in Details: Provide details like the loan amount, your income, and employment details.

- Upload Documents: Submit the required documents for verification.

- Loan Approval: Once verified, the bank will approve your loan and contact you for further steps.

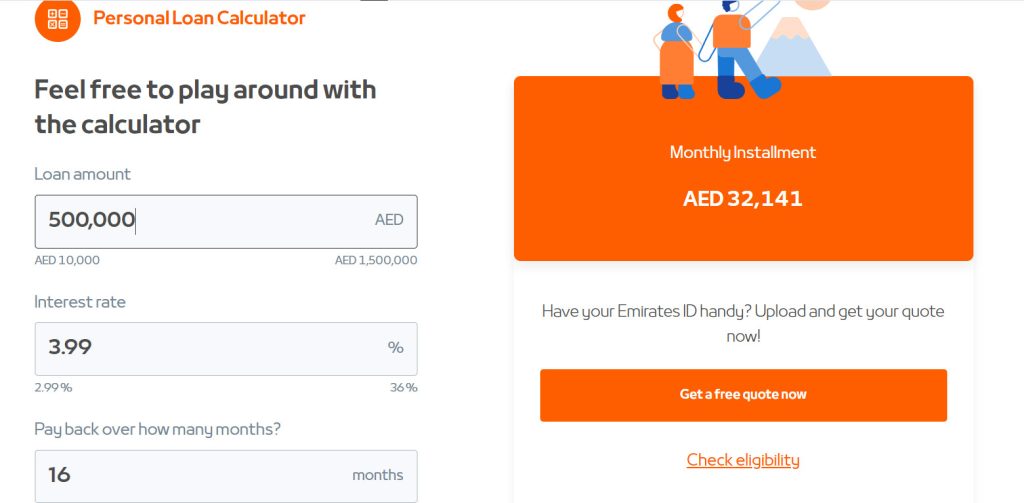

Using the Mashreq Bank Loan Calculator

Mashreq Bank provides a personal loan calculator on their website. This tool helps you estimate your monthly payment (EMI). Here’s how to use it:

- Go to the Mashreq Bank personal loan page.

- Enter the loan amount you want to borrow.

- Choose the interest rate and repayment term.

- The calculator will display your monthly EMI and the total repayment amount.

Why Use the Loan Calculator?

- To know your monthly commitment before applying.

- To plan your finances better.

- To compare Mashreq Bank’s loan options with others.

Factors That Affect Loan Approval and EMI

Understanding these factors will help you secure a loan and manage your repayment effectively:

- Loan Amount: Higher loan amounts result in higher monthly payments. Borrow only what you need.

- Loan Term: A longer loan term reduces your EMI but increases the total interest you’ll pay.

- Interest Rate: Lower interest rates mean smaller EMIs. Mashreq Bank offers rates starting at 2.99% per year.

Tips for a Smooth Application Process

- Check Your Eligibility: Use Mashreq Bank’s eligibility criteria to ensure you qualify.

- Gather All Documents: Double-check that you have the required paperwork ready.

- Use the Loan Calculator: Know what to expect in terms of monthly payments.

- Maintain a Good Credit Score: Timely payments on previous loans and credit cards improve approval chances.

Final Thoughts

Mashreq Bank personal loans are a flexible and reliable way to meet financial needs in the UAE. By understanding the loan features, eligibility criteria, and application steps, you can easily access the funds you require.

Use tools like the Mashreq loan calculator to plan your repayment smartly. Ensure all documents are in order for a hassle-free application process.

Frequently Asked Questions (FAQs)

1. What is the minimum salary for a Mashreq Bank personal loan?

You need a monthly salary of at least AED 5,000 if working for an approved company or AED 10,000 for unapproved companies.

2. How much can I borrow?

You can borrow up to 20x your salary, with a maximum limit of AED 1 million.

3. Is salary transfer mandatory?

Yes, most Mashreq Bank personal loans require a salary transfer.

4. What is the repayment tenure?

You can choose a tenure of 3 to 60 months.