Calculate Your Personal Loan EMI

Sorry

This video does not exist.

| Period | Payment | Interest | Balance |

|---|

Calculator Disclaimer

The repayment amount shown is an estimate based on the information you provide. It is for illustration only, and actual repayment amounts may vary. To get the actual repayment amount, Contact us or visit the official bank website or Nearby Banks. This calculation is not a quote, loan approval, agreement, or advice from My Finance. It does not consider your personal or financial situation.

The ADCB Personal Loan Calculator is an online tool to estimate your monthly payments (EMIs) when you take a personal loan. By inputting details like loan amount, interest rate, and tenure, you can see the amount you will pay each month.

Why Use the ADCB Personal Loan Calculator?

Here are the benefits:

- Accurate Calculations: Gives precise EMI amounts based on your inputs.

- Quick Decisions: Helps compare loan options in seconds.

- Better Planning: Allows you to see how loan amounts and durations affect your budget.

- Transparent Details: Breaks down your EMI into interest and principal amounts.

Features of the ADCB Personal Loan

ADCB offers personal loans tailored for UAE nationals and expatriates. Below are the details:

| Criteria | For UAE Nationals | For Expatriates |

|---|---|---|

| Interest Rate | Starting at 4.99% p.a. | Starting at 5.75% p.a. |

| Max Loan Amount | AED 4,000,000 | AED 1,500,000 |

| Min Loan Amount | AED 15,000 | AED 15,000 |

| Repayment Period | Up to 4 years | Up to 4 years |

| TouchPoints Rewards | 300 per AED 1,000 borrowed | 300 per AED 1,000 borrowed |

Other features include:

- Free ADCB credit card.

- Up to 2 deferments allowed annually.

- Overdraft eligibility: Up to 3 times your salary (UAE nationals) or 2 times (expatriates).

- Consolidation options for other debts.

- Life insurance available (additional charges apply).

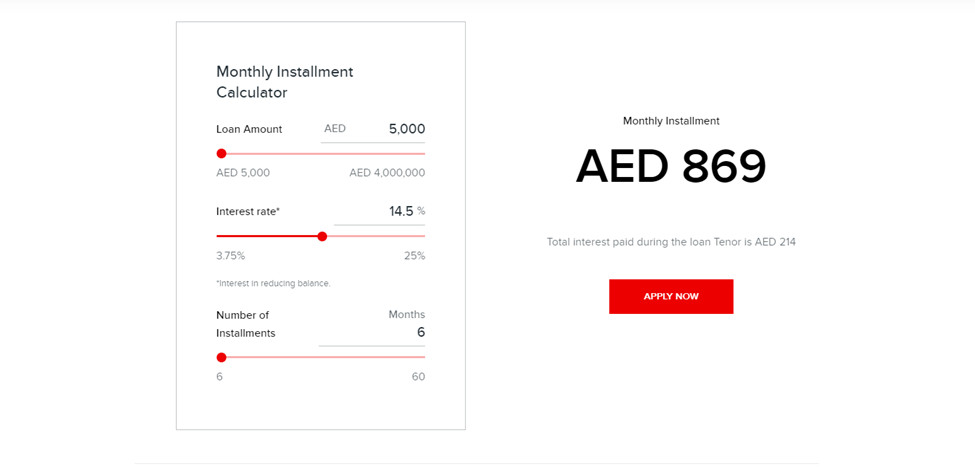

How to Use the ADCB Personal Loan Calculator

Follow these steps:

- Go to the ADCB Website: Access the loan calculator from the personal loan section.

- Input the Loan Details:

- Loan Amount: Enter how much you want to borrow.

- Interest Rate: Add the interest rate percentage.

- Loan Tenure: Choose how many months you plan to repay.

- Adjust Using Sliders (if available): Move the sliders to test different values.

- Get Your EMI: Instantly view your estimated monthly payment.

Eligibility for ADCB Personal Loan

Make sure you meet these requirements:

- Age: At least 21 years old. Expatriates must repay by age 60; UAE nationals by age 65.

- Income: Minimum AED 5,000 monthly salary.

- Bank Account: Must open a current account with ADCB for salary transfer.

- Salary Transfer: Mandatory transfer of salary and end-of-service benefits to ADCB.

Documents Needed

Prepare these before applying:

- Completed application form.

- Salary certificate (dated within 30 days).

- Bank statements for the past 3 months.

- Passport copy and Emirates ID.

- Salary transfer letter.

- Details of existing loans (if any).

Fees and Charges Associated with ADCB Personal Loan

The following table outlines the charges and fees related to the ADCB personal loan:

| Parameters | Fees and Charges |

|---|---|

| Processing fees for new loans and buyout loans. | 1.05% of the loan amount, with a minimum of AED 525 and a maximum of AED 2,625. |

| Top up loans processing fees | 1.05% of the loan amount, with a minimum of AED 525 and a maximum of AED 2,625. |

| Privilege Club and excellency clients – processing fees | 1.05% of the loan amount, with a minimum of AED 525 and a maximum of AED 2,625. |

| Credit life insurance | 0.0168% x loan tenure (in months) x loan amount |

| Early settlement or partial settlement fees | 1.05% of the settled amountMaximum – AED 10,500 |

| Instalment deferment | AED 105 per deferment |

| Penalty for the delayed amount | AED 105 per deferment |

| Loan cancellation fee | AED 105 |

| Loan rescheduling fee | AED 262.50 |

| Other documents (issuing redemption statement, loan copy, audit confirmation) requested by customers | AED 26.25 |

How to Apply for a Loan

You can apply online through the ADCB website UAE:

- Fill out the loan application form online.

- Provide the required documents.

- Choose your loan option and submit your request.

- Receive a decision within 3 business days after submitting all documents.

Key Points About ADCB Personal Loans

- Repayment Flexibility: You can defer payments twice a year.

- Life Insurance: Required; a one-time fee is charged.

- Early Settlement Fee: Applicable if you repay the loan early.

- TouchPoints Rewards: Earn points for every AED 1,000 borrowed, which can be redeemed for various benefits.

| Loan Amount | TouchPoints Earned |

|---|---|

| AED 10,000–150,000 | 200 per AED 1,000 borrowed |

| Over AED 150,000 | 300 per AED 1,000 borrowed |

This guide explains how the ADCB Personal Loan Calculator simplifies loan planning and decision-making. Use it to calculate your monthly payments and choose the best loan option for your needs.